how much state tax do you pay on a 457 withdrawal

If you are unable to pay the full amount due you should still file a return and consider making payment arrangements. Federal Income Tax Calculator 2022 federal income tax calculator.

The 457 is similar to the more widely known 401k plan where you can choose to contribute to the 457 plan through automatic deductions from your paycheck before the taxes are taken out.

. Roth IRA Withdrawal Rules. The District of Columbia has repealed its inheritance tax. The states that charge an inheritance tax are Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

Apply online for a payment plan including installment agreement to pay off your balance over time. Taxes are unavoidable and without planning the annual tax liability can be very uncertain. The 403b and 457b plans are both tax-deferred retirement savings accounts that cover nonprofit entities like governments churches and charities.

You only pay New Jersey tax on the amount that exceeds what you contributed to the plan. Avoid a penalty by filing and paying your tax by the due date even if you cant pay what you owe. For example if you fall in the 12 tax bracket rate you can expect to pay up to 22 in taxes including a 10 early withdrawal penalty if you are below 59 ½.

Certain employers may offer both types of plans. New Jersey has two ways to calculate tax. How Much Are The Death Tax Rates.

In most cases the tax rate that you pay depends on the value of the decedents taxable estate. Visit us to learn about your tax responsibilities check your refund status and use our online servicesanywhere any time. They differ in that 403b withdrawal rules are more like 401k withdrawals.

Also like the 401k money grows tax-deferred in a 457 retirement account until the time you withdraw the money. Youll pay a penalty tax if you withdraw funds before reaching age. Welcome to the official website of the NYS Department of Taxation and Finance.

Below you will find links for methods to pay your Maryland tax liability. When you make a withdrawal from a 401k account the amount of tax you pay depends on your tax bracket in the year when the withdrawal is made. Use the following calculator to help determine your estimated tax liability along with your average and marginal tax rates.

Otherwise you could be taxed twice on the same i ncome. Calculate how much of your annual distribution result s from after-tax earnings and how much result s from capital gains to figure out what you owe in taxes. We will process your return and then send you an income tax notice for the remaining balance due for nonpayment of taxes.

For individuals and businesses. Your Age 5-Year Rule Met Taxes and Penalties on Withdrawals Qualified Exceptions. First we will discuss Federal estate tax.

Click here for a 2022 Federal Tax Refund Estimator.

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

457 Contribution Limits For 2022 Kiplinger

457 Vs Roth Ira What You Should Know 2022

How To Utilize Your Non Governmental 457 B Plan White Coat Investor

Is The Tsp A 457 Plan Government Worker Fi

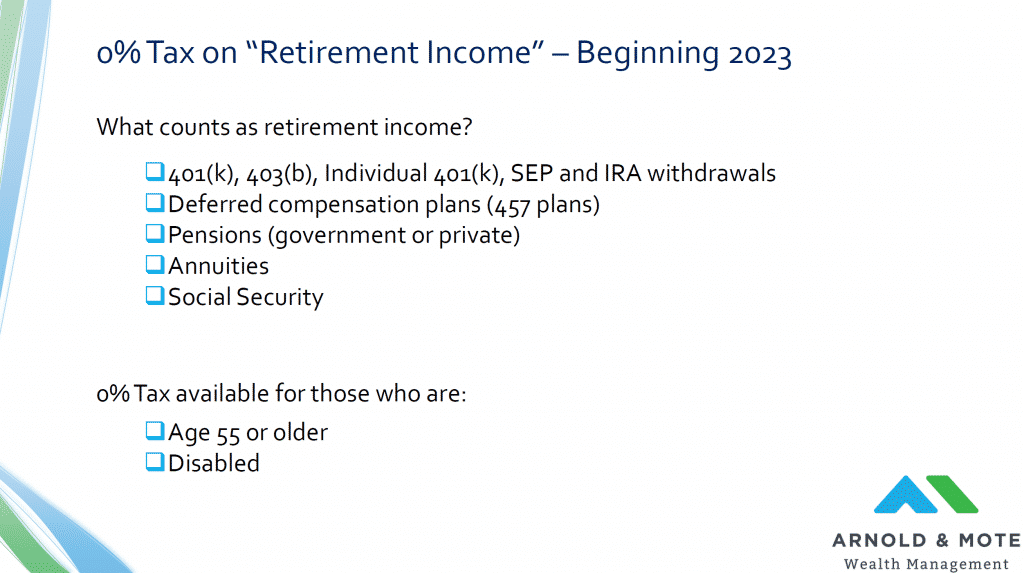

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

How A 457 Plan Works After Retirement

Revisiting And Revising The Investor Policy Statement Physician On Fire Investors Deferred Tax Capital Gains Tax

New York State Deferred Compensation Plan Boces

Revisiting And Revising The Investor Policy Statement Physician On Fire Investors Deferred Tax Capital Gains Tax